Top Reasons Forex Traders Fail

If necessary, print the form if it is to be completed by hand. Note on the form how the cash withdrawal should be handled. Most Euro to Norwegian Krone Rate brokers provide an option to wire the funds to your bank account. This almost always incurs a wire transfer fee on both ends, charged by your broker and also your bank.

Since you initially bought to open the trade, to close the trade, you now must sell in order to close the trade so you must take the “BID” price of 1.4550. The main reason SEK/JPY Chart is so popular is that it’s easy to access. You can do nearly everything you need to do from anywhere with an Internet connection. Most people will have a dedicated software platform on their computer at home, but will also be able to use browser-based programs on their laptops, and even apps on their smartphones. And as the Forex market is open constantly throughout the working week, you can trade whenever you want.

Locate the online ACH transfer form, which is usually a web-based form completed entirely online. Indicate the amount of the transfer, and whether the transfer is a deposit or a withdrawal. Once you submit the form, the transfer process begins without any further interaction from you. Create an ACH relationship with your Forex broker. These allow you to easily transfer funds electronically between your bank account and your broker.

But keep in mind that it’s usually harder to build a $100 account than it is to build one that starts with $1,000. The reason is that a profitable trade on the lesser amount will leave you feeling unsatisfied. This can lead to overtrading and overleveraging the account. Whatever amount you deposit into a Forex trading account should be 100% disposable.

If USD/JPY plummets and your trading losses cause your account equity to fall below $1,000, the broker’s system would automatically close out your trade to prevent further losses. By trading on brokers directly, this option is not available. With robots you are much more likely to place the right investments and if you do, you have a chance to earn up to thousands of euros in short periods of time.

But American laws do not prohibit citizens of this country to trade on the Forex market. One of the common myths among nonprofessional traders of the Forex market is that Forex is banned in the United States of America. But in the American market, the work of brokers is very tightly and carefully monitored. Take our quiz to discover your trading personality in minutes with just six simple questions. Then find out how you compare to other traders before you start your forex training journey.

You need to get familiar with Forex trading terminal. Education and Training for Beginners You broker provides you with demo-accounts, training courses and workshops, video tutorials, news, charts and market analytics so that you can practice your trading skills.

The https://maxitrade.com/en/nok-jpy/ market has several outlets, from the currency exchange booths on the street to the currency trading desks of big banks. Forex.com is a global FX and CFD broker established in 2001. Forex.com is the brand name of GAIN Capital, which is listed on the New York Stock Exchange. The company is regulated by several financial authorities, including the top-tier Financial Conduct Authority (FCA) in the UK or the US Commodity Futures Trading Commission (CFTC).

What the heck is leverage?

- Risk is managed using a stop-loss order, which will be discussed in the Scenario sections below.

- The functions are the same, and will allow you to trade on-the-go without confining you to your desk.

- Most new traders never have concern themselves with finding out the specifics of taxes in relation to forex trading.

- We also score positively if the broker provides a great amount of currency pairs, great desktop platform, and advanced charting tools.

- This forces you to be an active day trader, whether you want to day trade or not.

- At this rate it could take a number of years to get the account up to several thousand dollars.

Forex (FX) is the market where currencies are traded and the term is the shortened form of foreign exchange. Forex is the largest financial marketplace in the world. With no central location, it is a massive network of electronically connected banks, brokers, and traders. CFD and Forex Trading are leveraged products and your capital is at risk. Please ensure you fully understand the risks involved by reading our full risk warning.

Elias, the point of this post is that you need to trade like the casinos (by stacking the odds in your favor). By its very definition, trading is gambling (so are many things in life), but that doesn’t mean you can’t profit consistently. gambling is done on the basis of probability whilst forex trading is done on the basis of facts [technical and fundamental analysis. How do you not realize that any human endeavor at which one can become better over time is not gambling? Sit down, get yourself a good computer and start learning to read price movements.

When your position is rolled over, your online broker in the background basically closes your current spot position https://maxitrade.com/en/ and opens a new one. This is not visible for you, but it has a fee, called the rollover or financing fee.

To me, trading shouldn’t be about impressing some person and opening an account with $1000 just to show that you’re ”serious”. Why would someone expect to make lots of money from $100? If someone is trading with such low amounts, then they should expect low returns… It’s that simple. This split money management works well with risking dollar amount not the 2% that brokers are promoting.

There are many types of forex software that can help you learn to trade the forex market. However, if a trader stays with spread betting, no taxes need to be paid on profits. Also, if a trader is managing funds or trading for an institution there are many other tax laws that one may have to abide by. Losing trader tend to prefer section 988 because there is no capital-loss limitation, which allows for full standard loss treatment against any income. In the United States there are a few options for Forex Trader.

Get Free Forex Setups From Justin Bennett

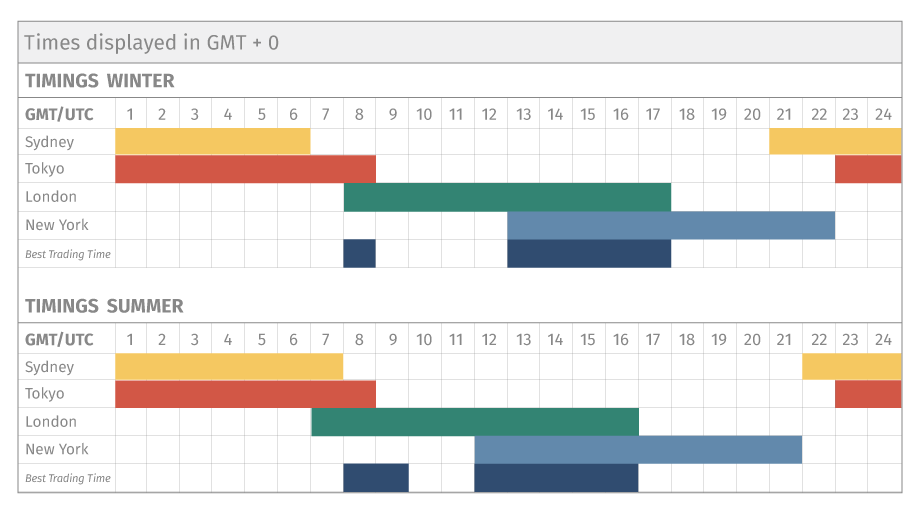

You can choose when to trade – the European, US and the Asian trading sessions follow each other. When trading sessions in different time zones overlap, the available liquidity in Forex reaches its maximum. The major participants of the Forex market are commercial and central banks, large corporations and hedge-funds. However, you do not need to have millions or thousands of dollars to start!

The surprise move inflicted losses running into the hundreds of millions of dollars on innumerable participants in forex trading, from small retail investors to large banks. Note that those numbers were cited just two months before an unexpected seismic shock in the currency markets highlighted the risks of forex trading by retail investors. On January 15, 2015, the Swiss National Bank abandoned the Swiss franc’s cap of 1.20 against the euro that it had in place for three years. As a result, the Swiss franc soared as much as 41% against the euro and 38% versus the U.S. dollar on that day.

Recent Comments